While physicians as well as hospital clinical and operations staff are focused on patient care and the clinical side of health care, the financial leaders—including CFOs, financial analysts, business, strategy and contracting/payer relations teams—have their own focus: beginning to forecast the pandemic’s effects on the bottom line.

This forecasting and future planning is essential to ensuring the health care system is still viable and strong as leaders manage through the crisis. Understanding and modeling the financial impact is challenging, however, what with so many critical forces in play from all avenues and key stakeholders.

From the provider perspective, hospitals and physicians are experiencing extreme financial challenges due to the pandemic and its effects on the economy. Most hospitals in the country, especially non-for-profit hospitals, have very low profit margins to begin with, ranging typically from 1-4% net margin. There are no extra funds just sitting there waiting for such a crisis as this.

Independent physicians have even lower margins, and many have sought venture capital funds to survive or grow, with those funds having significant payback requirements. As a result, Moody’s Investor’s Services has shifted the outlook for nonprofit hospitals downward from stable to negative. According to a recent Kaufman Hall study, in one month into the pandemic, hospital operating margins fell more than 100%.

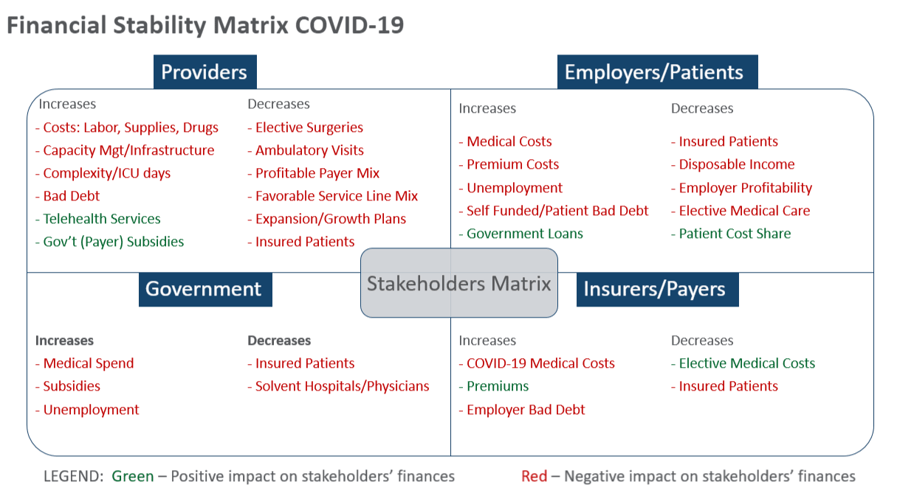

As the matrix above outlines, health care providers face unprecedented and more importantly, unbudgeted cost increases, compounded by extreme revenue losses stemming from cancellation of very profitable elective surgeries and ambulatory visits. Employers, consumers/patients, insurance companies and federal and state governments also have financial stability issues. Indeed, the “closing of the economy” is taking its toll on most health care stakeholders, with one notable exception being the health insurance industry, which is projected by Moody’s Investor’s Services to remain profitable during the COVID crisis with a stable outlook. Even at a mild to moderate infection level, Moody’s feels insurers should perform strongly with the significant decrease in non-COVID utilization and cost. This provides opportunities for payers to partner with and assist providers in the financial recovery process.

Financial Mitigation Strategies

To manage this situation, there are strategies and proactive planning that health care finance and business leaders can begin to implement, such as forecasting and modeling the changes in expenses and revenues for the next critical 6 – 18 months. Thinking outside of the hospital walls and leveraging value-based care, telehealth, innovation and technology will be key. Partnership opportunities with governmental and commercial payers and employers can also be a driving force to stabilize and preserve revenue and margin—everyone is in this together and wants to help each other survive and thrive.

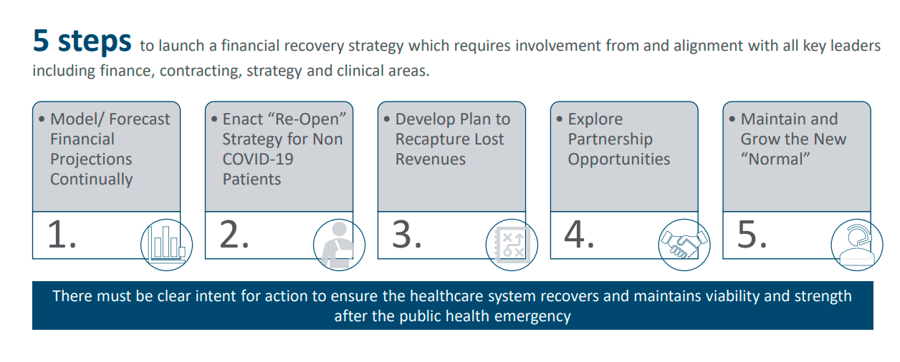

Below are five key steps that providers should begin to plan and implement.

1. Continually Model/Forecast Financial Projections

Each provider organization needs to develop a financial model that tracks current real-time expenses, revenue losses, forecasts, and changes in volumes to manage expenses and optimize revenues. Key levers are outlined below:

- Expense projections: increases in direct expenses to labor, supplies, drugs, etc.

- Revenue projections: increases in COVID case revenue and telehealth and offsetting losses in elective surgeries, ambulatory visits, other services

- Volume projections: COVID, non-COVID cases

- Relief revenue projections: estimate additional revenue you expect from the government’s relief dollars (including your percentage of the $100B, 2% sequestration, 20% increase for COVID DRGs, Medicaid disproportionate share reduction halt)

- Cash flow projections: changes to cash flow with CMS accelerated payments and repayment timeframes

- Margin projections from all the levers above

Once each organization is past the peak of their COVID cases:

2. “Re-Open” Strategy for Non COVID Patients

Begin now on your strategy for the re-emergence of elective cases and the rescheduling of these surgeries, routine ambulatory visits, and preventive services. Even after the government says it is OK to re-open the economy and loosen “shelter in place” guidelines, patients will be hesitant to return to physician offices and hospital campuses, out of fear of COVID exposure.

On April 19, CMS released guidelines for hospitals to restart elective surgeries while maintaining their ability to treat COVID-19 patients. Each hospital system’s recovery plan should include designating one hospital or isolated floors of a hospital solely for COVID and then set up other hospitals, ASCs, and other physician and ambulatory settings as non-COVID designated facilities, so patients feel safe returning for health care services. As a stand-alone provider, you can also designate COVID areas, if you are treating both types of patients or alternatively, market to patients that you are not treating COVID patients and are open for business.

3. Strategy to Recapture Lost Revenue

Based on the financial projections under your financial model, it will be important to understand the financial deficit and how your organization can begin to recapture these lost revenues and margin through an on-going cashflow analysis. Strategies should include the following:

- Applying for federal and state governmental subsidies

- Accelerated payments for existing accounts receivable from all payers

- Prospective payments for future accounts receivable from all payers (CMS quickly offered a program, but few commercial payers have followed suit)

- Renegotiation of fee-for-service (FFS) revenues and value-based case (VBC) incentives with commercial payers

- Reduction in costs by working with payers to waive or reduce administrative costs and denial costs – prior authorization, referrals, utilization management, etc.

- New business opportunities for growth and new patients

4. Partnership Opportunities

Begin dialogues immediately with your commercial payers on how they can help providers. As outlined above, the health insurance payers are currently seeing a windfall caused by lower medical expenses compared to budget, so these dollars should be accessible to providers.

Payers have yet to go as far as the federal government and provide loan-free dollars to providers, but a few have provided some relief dollars or advance loans. The payers are not going to proactively outreach to all providers, so providers need to leverage their individual relationships and contracts with payers and make the first move.

There are many opportunities (examples listed below) to negotiate new, creative revenue sources and value-based care (VBC) partnerships that can result in some immediate cash infusions from payers. This can serve as a new path to accelerate the movement to VBC and help providers be less dependent on FFS retrospective revenues.

- Site of Service revenue conversion: I.e. cases that move from high acuity tertiary hospitals to lower reimbursed community hospitals or ambulatory surgery centers. Negotiate reimbursement to maintain tertiary reimbursement levels. For example, with in person visits that moved to telehealth, negotiate reimbursement at in-office rates.

- Prospective payments for future quality or pay-for-performance earnings: These dollars are already budgeted by payers and should be available for immediate cash infusions based on historical performance

- Renegotiation of existing payer FFS contracts to recapture the revenues lost to date: There will be a slow ramp-up of elective surgery volumes and providers will not likely recapture a significant piece of these lost profits. These dollars can be forecasted and built into future revenues or moved into incentive programs outlined below.

- New value-based care (VBC) initiatives that can supplement fee-for-service revenues:

- Direct to Employer opportunities

- Quality incentives (e.g. link foregone elective surgery revenues to a quality P4P initiative)

- Care Management PMPMs

- Shared savings arrangements

- Episodic advance payments

- Prospective payments for future VBC earnings

- Held harmless on any downside risk dollars

5. Maintaining the New Normal

Some of the new business opportunities, in addition to increasing revenue and growth, can solidify the services and efficiencies that evolved during this crisis. Instead of letting things go back to the way they were, develop a strategy to maintain these new normal positives. This includes telehealth, other technology innovations, capacity and service line management, work from home cost efficiencies, accelerated site planning and activation. Many of the telehealth and new technologies were not previously recognized by governmental and commercial payers for reimbursement. Now is the time to lobby the government to keep the new loosened rules and negotiate with the commercial payers to permanently add these services and reimbursement terms to payer contracts.

In addition, significant cost efficiencies can be maintained by continuing with work-from-home arrangements for certain staff and maintaining new surge management capabilities. Moving ahead with the accelerated planning used to create makeshift hospitals and new ICU units can be used during Phase 2 and 3 of the COVID-19 recovery to more quickly bring new facilities and services to market.

Providers have been flexible and enterprising in their efforts to efficiently and effectively manage this pandemic and save countless lives, so any positive or promising changes should be integrated into the new normal, with the results likely to be increased growth, revenue, innovation, efficiency and value based partnerships. Payers need to step up and do their part with providers in this crucial period and help pave the way for financial recovery and stability. For all stakeholders, this needs to serve as a proactive path for better preparedness for any future heath care challenges.

Share this: